My Journey: ESG and Impact Investing

As I dive into my studies for the ESG and Impact Investing Certification from the Frankfurt School of Finance and Management, I've been reflecting on how these concepts play out in Central America and specifically the Honduras context. Here are some of my thoughts and insights regarding the path toward sustainability.

The regulation-driven transition and misconceptions

It is becoming increasingly common for organizations to adopt ESG practices to comply with regulations, but there is still a lot of confusion between the different terms used interchangeably -- Social Responsibility, Impact, and ESG (Sustainability). It's important to understand that ESG isn't just about doing good deeds, but also integrating environmental, social, and governance factors into business strategies. As global markets are driving us from the triple bottom line to reducing our environmental footprint and respecting human rights while performing economically, we must recognize the changing rules of the game.

It's been a decade

Upon returning from Germany in 2016, I began training organizations on topics such as "Triple Bottom Line and social innovation". As I looked at the “Who Cares Wins” guidance from 2006, I realized we were about 10 years behind. In spite of this, it's still a concept still being redefined in many countries, both here and globally. Global and regional regulations are changing rapidly, so we need to catch up quickly to build a long-term sustainable, regenerative economy.

Still Transitioning to 2024

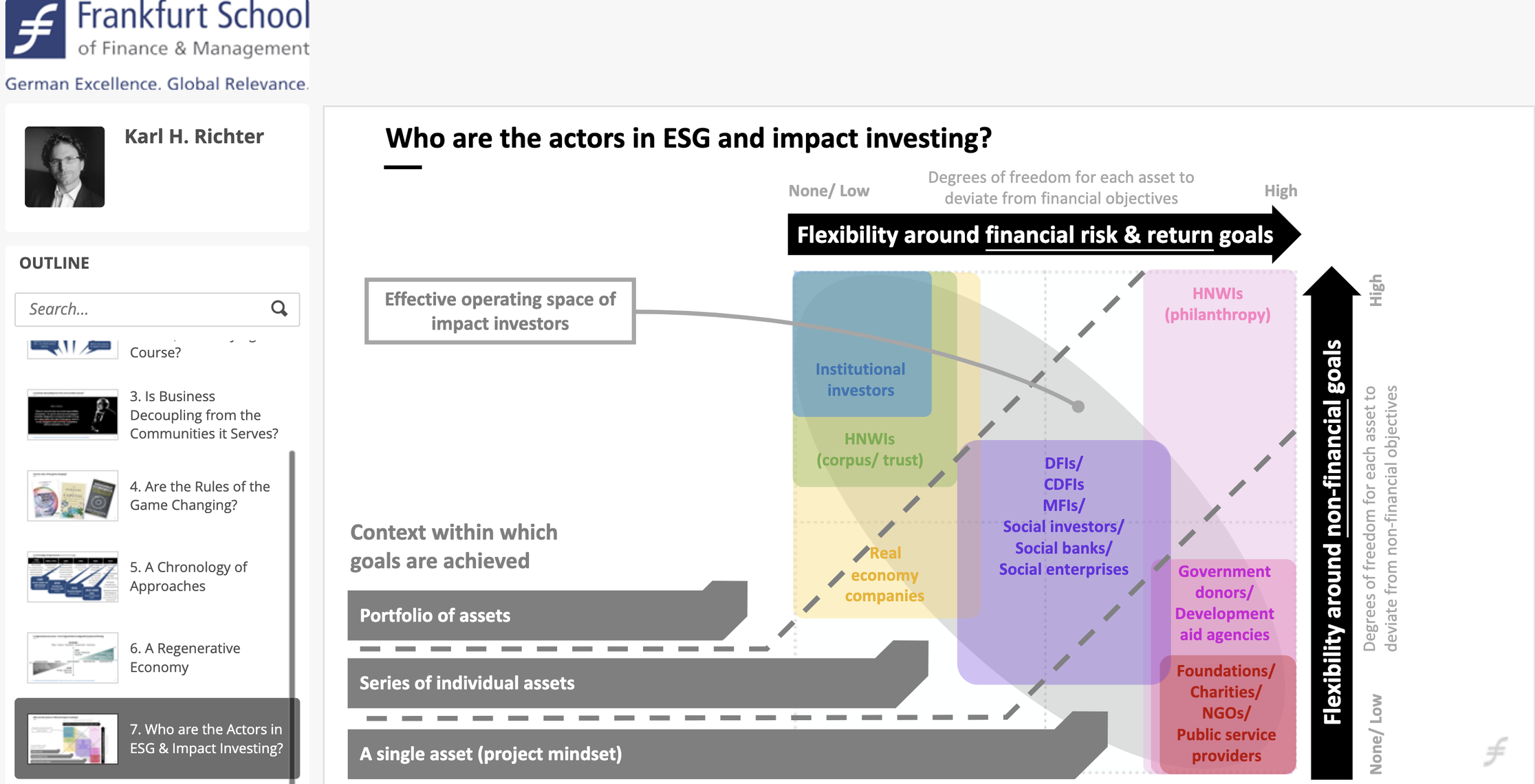

"Fast forward to 2024, and we're still figuring it out with new concepts and objectives like Impact Investing and Sustainable Investing. On one hand, most organizations are trying to balance the three pillars of ESG. Interestingly, financial entities, driven by compliance requirements (like SARAS), have started to include impact investing in their credit portfolios. On the other hand, this shift also means we’re seeing more emphasis on responsible supply chains and ensuring that investments contribute to positive environmental and social outcomes".

COVID-19 and ESG Investing

The pandemic crisis has demonstrated that ESG investing leads to better risk-return relationships. It's clear that sustainable investments are not just beneficial for the planet—they're also financially rewarding. Data suggests that companies with strong ESG practices, particularly those focusing on community activism and responsible supply chains, performed better during the crisis.

Reevaluating CSR

It’s time to rethink whether our investments in Corporate Social Responsibility (CSR) projects are truly making an impact and helping us move towards sustainable investing. To avoid being stuck in the 2006 mindset, we need to ensure that we are genuinely addressing our environmental footprint and including human rights in business practices, fostering a regenerative economy.

Finally, by sharing these reflections, I hope to contribute to the ongoing discussions among changemakers striving for a more sustainable future, where our efforts are both impactful and forward-thinking. Let’s keep pushing the boundaries and making a real difference.